In 2022, the federal government proposed the CDCP with the intention of easing monetary barriers to dental care for eligible Canadian residents. This plan is not just a promise for a healthier future, but a step towards a Canada where quality dental care is accessible to all. With the CDCP set to roll out and become available to Canadians soon, it’s crucial that you’re familiar with what it brings to the table.

So, fasten your seatbelts as we dive into the world of CDCP and how it affects your family’s dental care.

What is the Canadian Dental Care Plan (CDCP)?

The Canadian Dental Care Plan (CDCP) is a federal government initiative aimed at providing dental coverage for Canadians who do not have private dental benefits and earn a household net income of less than $90,000 a year. It’s a significant shift towards making dental care more financially accessible, especially for those who have previously found the cost to be a barrier.

The CDCP is set to officially kickstart in May 2024. Though the coverage start date will be different for each person, the phasing in of this plan aims to ensure a certain degree of fairness and efficiency.

Once enrolled, depending on the family net income, patients may be required to make a co-payment, which is a personal contribution towards the cost of their dental care. However, it’s important to remember that the CDCP is a government dental benefit, not a free dental program, so there might be some out-of-pocket expenses.

The implementation of the CDCP signifies a notable shift in the landscape of Canadian healthcare, bringing us closer to bridging the gap between oral health and overall health.

Eligibility for the CDCP

So, who benefits from the Canadian Dental Care Plan (CDCP)? What does it mean to not have access to dental insurance? The answers to these questions are central to understanding whether your family qualifies for the plan.

Essentially, the CDCP is designed for Canadian residents who do not have private dental benefits.

Now, this could mean that you don’t have dental insurance through your employer or through a family member’s employer benefits, including health and wellness accounts. It could also mean that you don’t have dental coverage available through your pension or a family member’s pension benefits, or that you haven’t purchased dental insurance for yourself or your family.

However, the CDCP comes with a financial eligibility requirement as well. The program targets families with a household net income of less than $90,000 per year.

In addition to these, you should be a Canadian resident for tax purposes and must have filed your tax return in the previous year. It’s also important to mention that even if you have dental coverage through provincial, territorial, or other federal government social programs, you can still qualify for the CDCP, provided you meet all the eligibility criteria.

How to Apply for the CDCP

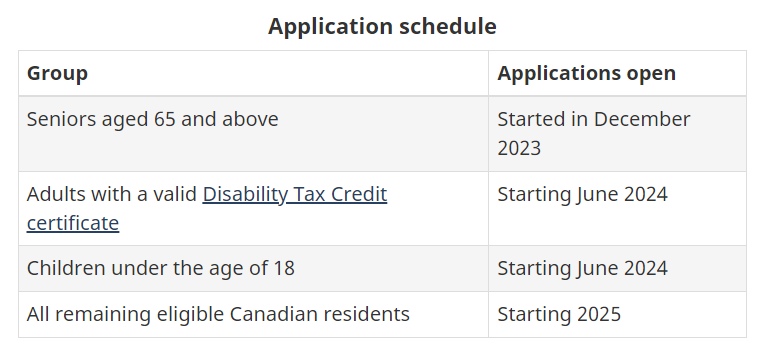

Applications for the Canadian Dental Care Plan (CDCP) will open in phases, as the Canadian government understands the importance of a smooth rollout process. The plan is to start with seniors and gradually move to other age groups and conditions.

If you are aged 65 to 69 or if you’re an adult with a valid Disability Tax Credit certificate, you can apply starting June 2024. The same applies if you have children under the age of 18. All remaining eligible Canadian residents can apply starting in 2025.

You might wonder, how do I know when to apply? The federal government started sending out letters to eligible seniors from December 2023 with instructions on how to apply. If you’re a senior over 70 years of age and have received a letter inviting you to apply for the CDCP, it’s crucial to keep in mind that your personal application code will expire on April 30, 2024.

For those eligible to apply starting in May 2024, you will be able to do so online. More information on the online application will be available closer to the date.

If applying online isn’t your cup of tea, you also have the option to apply via telephone, by calling 1-833-537-4342 and selecting option number 1.

Coverage under the CDCP

Alright, now that you know about the eligibility and application process, you may be wondering: what exactly does the CDCP cover? The answer is: a lot.

The Canadian Dental Care Plan (CDCP) covers a broad spectrum of dental services, aiming to cater to a wide range of oral health care needs for eligible Canadians. The coverage under the CDCP is categorized into three levels—preventive services, minor restorative services, and major restorative services.

Preventive services are measures taken to avert oral diseases before they start. These include routine check-ups, cleanings, fluoride treatments, sealants, and X-rays. It’s essential to note that preventive services are fully covered under the CDCP—no exceptions.

Minor restorative services are treatments for basic oral health concerns. These include fillings, root canals, extractions, and periodontal scaling. Finally, major restorative services encompass more complex dental procedures. These include crowns, bridges, dentures, and orthodontic services.

Now, let’s talk about preauthorization.

This term might sound intimidating, but all it means is getting an estimate from your dentist, then submitting it to the CDCP before you have any major restorative work done. This provides you with an understanding of how much the CDCP will cover and how much you’ll need to pay out of pocket. It allows you to plan and avoid any unexpected costs.

How much will be covered?

The CDCP will reimburse a percentage of the cost, based on established CDCP fees and your adjusted family net income. You may have to pay additional charges directly to the oral health provider, if:

- your adjusted family net income is between $70,000 and $89,999

- the cost of your oral health care services are more than the established CDCP fees, or

- you and your oral health care provider agree to services that the CDCP doesn’t cover

You may have a co-payment based on your adjusted family net income. A co-payment is the percentage of the CDCP fees that isn’t covered by the CDCP, and that you will have to pay directly to the oral health provider. Your co-payment is based on your adjusted family net income.

Co-payments based on adjusted family net income:

|

Adjusted family net income |

How much will the CDCP cover |

How much you will cover |

|

Lower than $70,000 |

100% of eligible oral health care service costs will be covered at the CDCP established fees. |

0% of the CDCP established fees. You may face additional charges as described below. |

|

Between $70,000 and $79,999 |

60% of eligible oral health care service costs will be covered at the CDCP established fees. |

40% of the CDCP established fees. You may face additional fees as described below. |

|

Between $80,000 and $89,999 |

40% of eligible oral health care service costs will be covered at the CDCP established fees. |

60% of the CDCP established fees. You may face additional fees as described below |

The CDCP fees may not be the same as what providers charge. You may have to pay fees in addition to the potential co-payment if:

- the cost of your oral health care services are more than what the CDCP will reimburse based on the established CDCP fees

- you agree to receive care that the plan doesn’t cover

Before receiving oral health care, you should always ask your oral health provider about any costs that won’t be covered by the plan. Make sure you know what you’ll have to pay directly to your oral health provider ahead of receiving treatment.

Closing Thoughts

There you have it! You have now been introduced to the Canadian Dental Care Plan, its benefits, eligibility requirements, coverage details, and financial implications. It’s all about making sure you and your family can access affordable dental care, no matter your income level or existing coverage.

As with any new government initiative, understanding the finer details of the CDCP is crucial. It ensures that you’re well equipped to take full advantage of the plan and secure the dental benefits you’re entitled to.

Remember, the health of your teeth and gums is a vital part of your overall health and well-being. Don’t let financial barriers keep you from accessing the dental care you need.

While the CDCP is a significant step towards making dental care more affordable, remember that it’s not a reason to delay necessary dental treatments or checkups. Regular dental care is essential for maintaining a healthy smile.

For more information about CDCP click here.

So, even if your CDCP coverage hasn’t kicked in yet, don’t put off taking care of your oral health.